Who is Matthew Babrick (CRD#: 4433983)?

Matthew Babrick is a Senior Managing Director and Wealth Manager at First Republic Investment Management. Babrick, a nationally recognized wealth manager, has over 15 years of expertise working with families and foundations to assist them reach their financial goals. Prior to joining First Republic in 2018, he was a Vice President at Goldman Sachs’ Investment Management Division. As a top performer at Goldman Sachs, he served on the firm’s Advisor’s Council, where he advised some of the firm’s largest clients in the Southwestern United States. He began his career at Merrill Lynch in the Private Banking and Investment Group. Babrick received his MBA from the University of Southern California’s Marshall School of Business.

This article will go deeper into Matthew Babrick’s past, uncovering hidden disclosures and SEC litigations, as well as analyzing the legal consequences.

About First Republic Investment Management

First Republic Private Wealth Management is an advisory firm situated in San Francisco, California. The team believes in customized approaches rather than a one-size-fits-all strategy. They provide wealth management plans that address your entire financial picture. Clients of First Republic Private Wealth Management work with a single wealth advisor who oversees a team of banking, investment management, trust, and brokerage specialists who collaborate and collaborate with you to effectively address your particular circumstance.

First Republic Private Wealth Management comprises First Republic Trust Company, First Republic Trust Company of Delaware LLC, First Republic Investment Management Inc., an SEC Registered Investment Advisor, and First Republic Securities Company, LLC, Member FINRA / SIPC.

The company offers Investment management services for high-net-worth individuals, families, pooled investment vehicles, pension and profit-sharing plans, charity organizations, and state municipal and government entities. The firm is a wealth management specialist that also provides trust, brokerage, and banking services. Additionally, the firm invests in public equities, fixed-income, and alternative investment markets.

First Republic Investment Management Services

First Republic Investment Management Services offers a wide range of services, some of which are as follows:

Investment Management Services:

First Republic offers objective, individualized wealth management solutions. Their wealth managers deliver customized investment advice to individuals, companies, governmental entities, and many nonprofit organizations.

Brokerage Services:

Their professionals offer full-service and self-directed brokerage services, with the sole goal of developing the best solutions for you. Their one-of-a-kind platform offers brokerage, trading, and custody services.

Trust Services:

First Republic Trust Company and First Republic Trust Company of Delaware LLC provide hands-on, personalized trust services, handling delicate matters with experience, objectivity, and intelligent decision-making.

Matthew Babrick Disclosures: BrokerCheck, FINRA, And SEC

BrokerCheck report of Matthew Babrick includes information such as employment history, professional qualification, disciplinary actions, criminal convictions, civil judgment, and arbitration awards as well as disclosures events.

According to the BrokerCheck report, a customer dispute type of disclosure has been reported against Matthew Babrick. In the disclosure, the client alleges inter alia, a misrepresentation that a margin loan would be an unsecured loan and that an unsuitable strategy was recommended because of commissions.

Financial Advisors often take down their client disputes from FINRA’s Public database through Disclosure Expungement. Even law firms provide expungement services to FAs so that they can hide or remove their client disputes and maintain a clean record. So the lack of any disclosures on BrokerCheck doesn’t necessarily mean that the broker hasn’t had any disputes in the past.

BrokerCheck

Source: https://brokercheck.finra.org/individual/summary/4433983

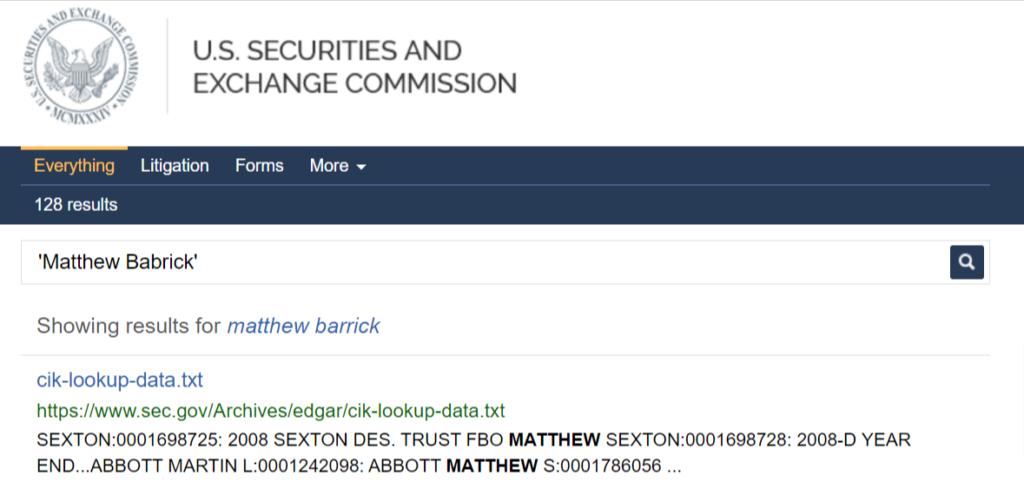

SEC Litigations & Forms

Source: https://secsearch.sec.gov/search?affiliate=secsearch&sort_by=&query=%27Matthew+Babrick%27

Matthew Babrick Lawsuits

Most court cases filed in the United States of America are archived on CourtListener, UniCourt, Law.com, Justia, Trellis, law, and Law360. If Matthew Babrick has been involved in any such lawsuits, then you can find the documents using the links down below:

https://www.courtlistener.com/?q=matthew+babrick

https://unicourt.com/search?q=matthew+babrick

https://www.law.com/search/?q=matthew+babrick

https://www.justia.com/search?q=matthew+babrick