To clarify the crucial aspects of this organization, I have several grievances with Phoenix Capital Group Holdings. There are some favorable reviews as well, but since that’s just how things work, we tend to focus on the bad ones. It is necessary to understand the background and history of Phoenix Capital Group Holdings before proceeding.

Phoenix Capital Group Holdings, LLC: A Brief Overview

A disputed oil and gas mineral rights acquisition and investment organization, Phoenix Capital Group Holdings, LLC was founded in 2019 and has its headquarters in Denver, Colorado. The company’s operations mostly include mineral rights purchases.

Several locations, including Irvine, California, Casper, Wyoming, Dallas, Texas, and Fort Lauderdale, Florida, are included among its satellite offices.

The corporation, which is controlled by a family, directs its efforts toward aggressive capital deployment and asset management. It often gives priority to initiatives that might be seen as abusing individual landowners and investors.

On the other hand, even though Phoenix Capital Group Holdings asserts that it combines extensive experience in the energy industry with sophisticated technology and professional financial skills, the strategy that it employs may be perceived as being self-serving and driven more by profit objectives than by a genuine dedication to the company’s customers.

Phoenix Capital Group Holdings, LLC: Clients Reviews Exposed the Truth

Concerning parts of Phoenix Capital Group Holdings, LLC’s business practices, and relationships with customers are brought to light by reviews of the firm.

Several complaints indicate concerns such as misleading information, bad customer service, and inability to keep obligations.

Allegations show that the company routinely participates in actions that possess the potential to be damaging to customers.

As a result of these assessments, it seems that the corporation may put its interests ahead of those of its consumers, which raises questions about the company’s dependability and level of ethical standards.

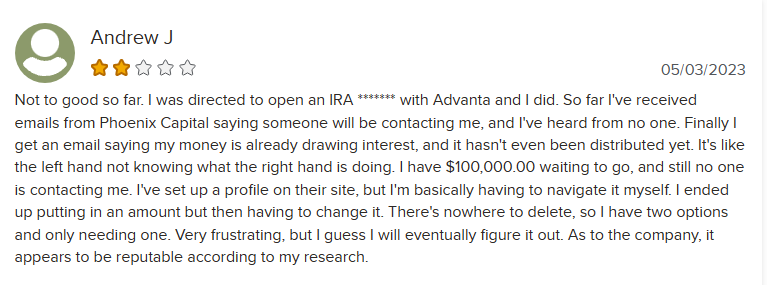

#1. Consumer Dissatisfaction

According to the assessment mentioned above, the individual claimed that they had formed an IRA with Advanta at the request of Phoenix Capital Group Holdings, LLC. They said that they had received emails from Phoenix Capital offering communication, but they had not received any response.

They were quite aback to learn, by email, that their money was accruing interest even though it hadn’t been disbursed yet. The observer observed that Phoenix Capital seemed to be lacking in internal coordination.

Despite having $100,000 ready to spend, they discovered that they were the only ones using the website. The inability to quickly change the amount they were investing in irritated them. Overall, they said that while Phoenix Capital seemed trustworthy based on their research, their experience had been delayed and unclear.

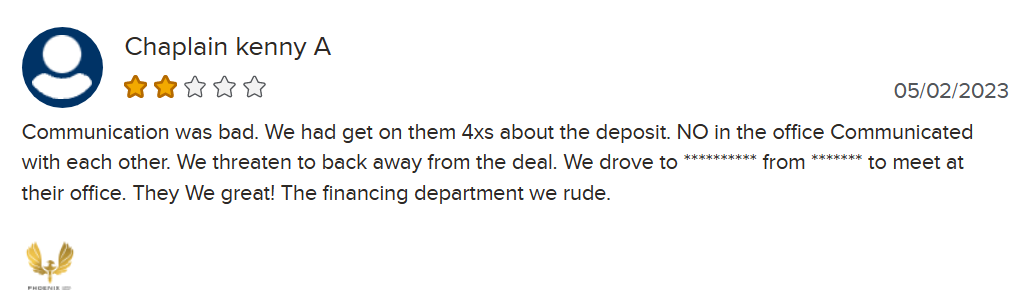

#2. Lack of Communication

In this case, the person complained about poor communication in the aforementioned evaluation. It took four attempts to get in touch with them before they could receive the deposit, they stated. They noticed that the employees at their workplace weren’t talking to each other enough.

They admitted to considering terminating the arrangement. Their journey from [location] to [location] to meet them at their workplace was finally completed. They spoke highly of the team’s performance. It was brought to their attention that the finance department had acted impolitely.

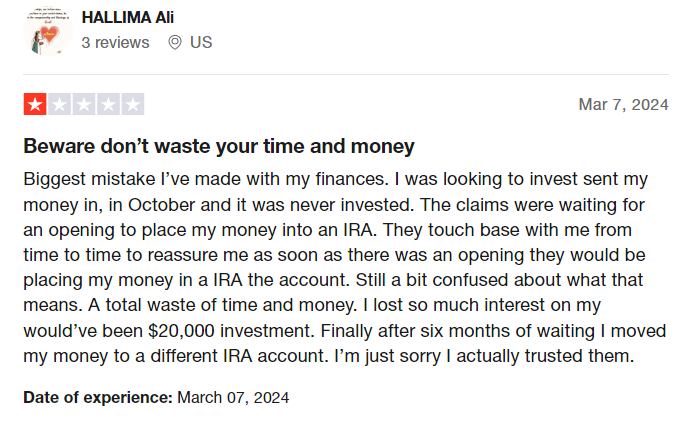

#3.Wastage of money & time

According to the reviewer, this was their worst financial mistake so far. Their October contribution, which they purportedly intended to invest, went unused.

They said that the company had informed them that they were waiting for an opportunity to roll over their IRA contributions. They said that the business would contact them regularly to reassure them that their funds would be transferred to the IRA account whenever a suitable occasion arose.

On the other hand, they admitted that they were confused about its meaning. They thought it was a complete waste of time and money since they lost a lot of interest on the $20,000 investment.

They waited six months before transferring the money to a different IRA account. Their trust in the company had been misplaced, and they regretted it.

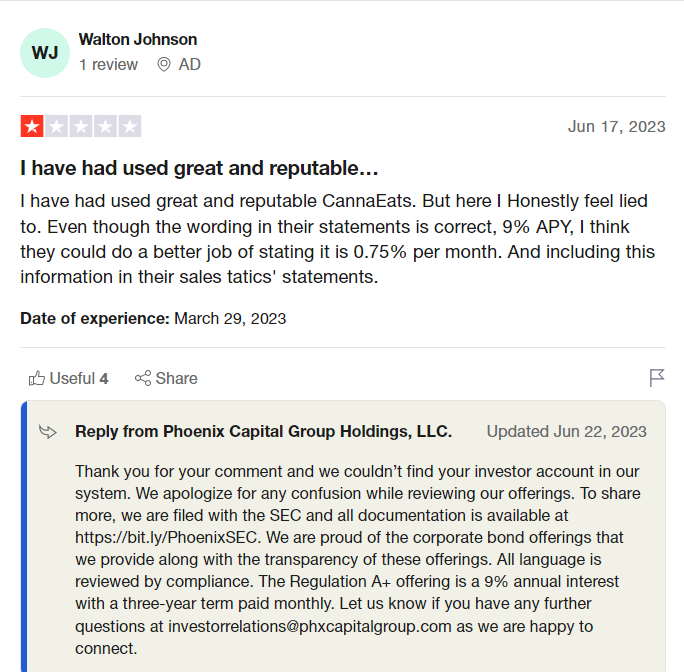

#4. Misleading

The individual said they had used CannaEats in the past and thought it was reliable and excellent. They felt, very honestly, misled by their present experience, nevertheless. They pointed out that while the 9% Annual Percentage Yield (APY) was referenced in the company’s disclosures, they felt CannaEats might have made it more obvious that this equated to 0.75% every month. They believed that the communications and sales presentations ought to have included this information.

SEC Allegations Against Phoenix Capital Group Holdings

Conclusion

According to the feedback from customers and the norms of the industry, Phoenix Capital Group Holdings, LLC has a reputation that is of ordinary quality. Although the company claims that it is a leading investor and purchaser of oil and gas mineral rights, the complaints received from customers reveal severe inadequacies.

Some clients have formed a negative image of the company as a result of problems with communication, delays in service, and tactics that some individuals consider to be deceptive about financial goods.

The organization’s operational performance and customer-centricity are called into doubt by these complaints, although the corporation asserts that it incorporates cutting-edge innovation, fiscal savvy, and deep industry expertise.

The claims that have been made against the Securities and Exchange Commission (SEC) and other regulatory agencies have brought to light possible problems with ethical and regulatory compliance. Before deciding to work together with Phoenix Capital Group Holdings, LLC, stakeholders and investors should do a comprehensive analysis of their financial goals and the degree to which they are comfortable with certain levels of risk.