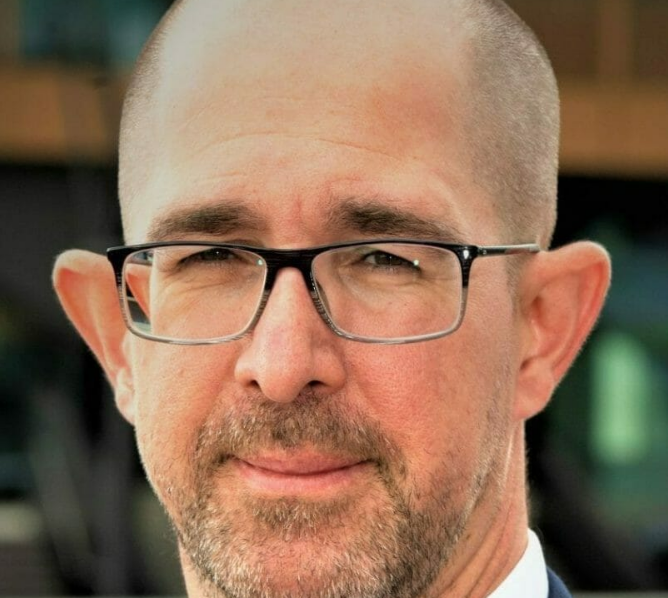

Of course, I’d be happy to discuss David El Dib’s role in Laetitude in more detail, paying special attention to his major contributions and any worries I may have about his actions. But let’s get a feel for his character first. Our primary objective is to delve into his personality and how it is reflected in his involvement with Laetitude and other deceitful schemes.

How David El Dib Skewed His Career: From Financial Expert to Alleged Crypto Fraudster

Enthusiasm and potential paved the way for David El Dib to enter the financial sector. He has always had a thing for numbers and a fascination with the stock market.

Following this, he worked his way up to private banking and consulting, where he became well-known for his expert commentary and advice on cryptocurrency and individual wealth. He established himself as a frontrunner in cutting-edge financial strategy after leaping into business by co-founding a private hedge fund.

But there’s a deeper story beneath this success mask. The recent endeavors of El Dib, especially his association with Laetitude, have caused considerable alarm among both investors and regulatory agencies.

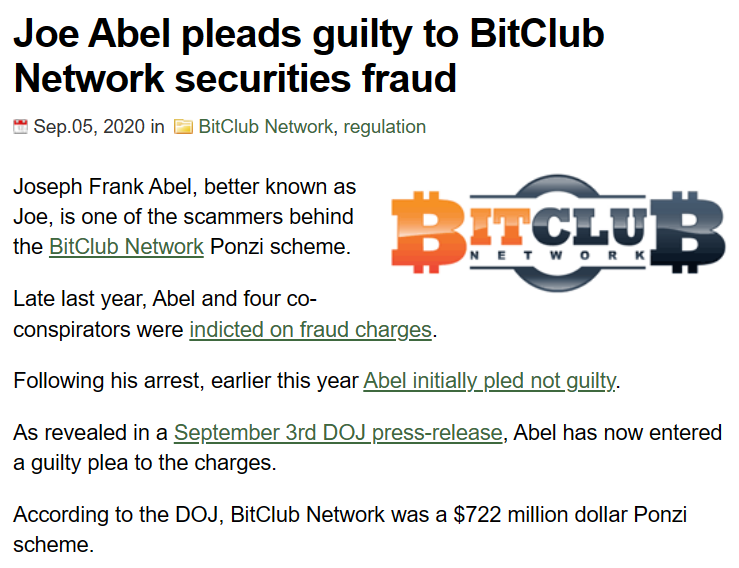

The Dubai-based company Laetitude advertises itself as a platform that provides automated bots for trading cryptocurrencies and guarantees high profits. Some have even gone so far as to say that Laetitude is much like BitClub Network, another infamous Ponzi scam.

El Dib has asserted his competence and success in his endeavors, however, there are claims that his dealings are not as open or legal as they seem.

There seems to be a disturbing trend, similar to previous financial disasters, in the rise of regulatory scrutiny and investor skepticism. His move to Dubai, a city generally seen as a sanctuary for questionable financial dealings, heightens the suspicions surrounding his business dealings.

El Dib’s current reputation as a financial expert and instructor is at odds with the claims that he used his position to entice wealthy people into fraudulent investment schemes. The financial community no longer sees Laetitude in the same light as before due to his unclear business methods and absence of registered securities offerings.

A cautionary tale in an industry full of promise and danger, David El Dib’s narrative is relevant as authorities continue to probe and investors exercise care. The complexity and dangers of cryptocurrency and high-risk investing are highlighted by his rise from a respected financial counselor to a person under investigation.

Concerns over the veracity of David El Dib’s financial dealings and their consequences for those who have put their faith in his plan to amass fortune continue to arise as his story progresses.

Many are wondering if El Dib walked the fine line between being innovative and being exploited in his quest for financial success, as the probe continues to reveal his exact impact on the financial world.

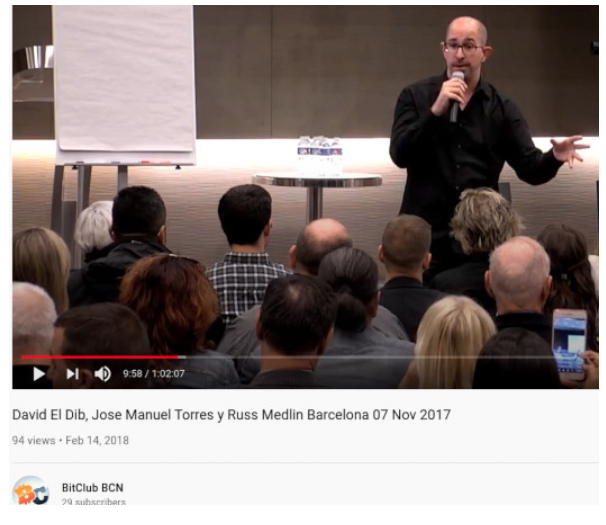

David El Dib’s Alleged Role in a Crypto Ponzi Scheme: The BitClub Network Revealed to the World

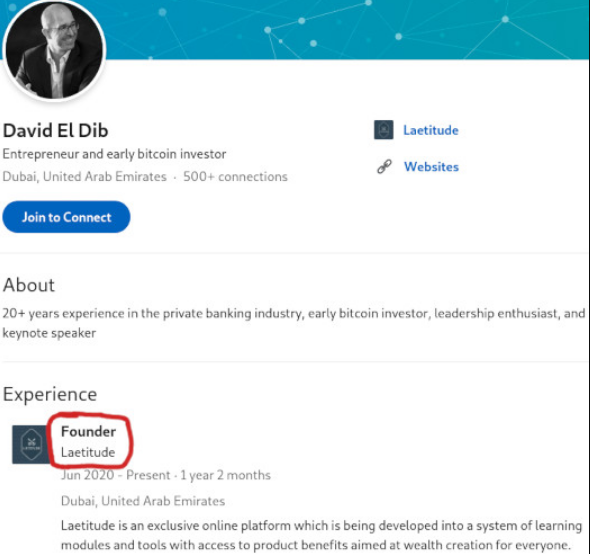

David El Dib, a figure who seems to be rising from the shadows of cryptocurrency frauds, has once again found himself at the heart of the controversy. El Dib, who was earlier known for his affiliation with the infamous BitClub Network, has recently reemerged as the supposed creator of Laetitude, a firm that is based in the United Arab Emirates and is operated under the umbrella of Spring7 FAZ LLC. This endeavor, which is being marketed as a new cryptocurrency trading platform, has come under intense attention because it is allegedly similar to fraudulent actions that have occurred in the past.

About BitClub Network

BitClub Network is said to have been the starting point for El Dib’s voyage into the world of malicious Bitcoin activity. Several sources indicate that he had a strong relationship with the management and routinely accompanied executives on promotional trips to different countries across the world.

The notorious BitClub Network, which was involved in a Ponzi scam that was worth $722 million, made a guarantee to investors that they would get large returns via Bitcoin mining pools. However, this claim was eventually shown to be fraudulent by authorities in the United States.

Does Laetitude’s Leadership Uphold the Tragedy of Deception?

The most recent initiative that David El Dib has undertaken is called Laetitude, and it has a sophisticated cryptocurrency trading platform that is driven by complex algorithms and automated bots.

Various promotional materials brag about the unrivaled accuracy and dependability of these bots, saying that they are always working to ensure earnings for investors regardless of the time of day.

On the other hand, under the surface of technical brilliance is a business plan that is strikingly similar to the deceitful activities of BitClub Network.

Concerning Claims of Unethical Practices

Laetitude is accused of being a Ponzi scheme by its detractors, who claim that the company relies largely on the recruitment of new affiliates and the investments made by those affiliates to maintain payments to previous investors.

The firm is said to not provide any actual items or services other than membership itself, which is a characteristic that is common among fraudulent multi-level marketing schemes.

Furthermore, regulatory agencies have expressed their worries since neither Laetitude nor its affiliated platforms, such as Swapoo, are licensed to provide securities. This is a fundamental error that has the potential to expose investors to considerable dangers.

Risks Related to Law and Regulation

Concerns have been raised over El Dib’s objectives with Laetitude as a result of his migration to Dubai, which is sometimes seen as a haven for those who are looking for protection from judicial scrutiny.

The fact that the firm was incorporated in the United Arab Emirates via Spring7 FZ LLC, which is a shell organization, makes inspection and regulation much more difficult.

According to detractors, this configuration makes it possible for Laetitude to function with a minimum level of responsibility, which might allow them to avoid legal repercussions comparable to those that BitClub Network’s culprits were subjected to.

Regulatory Oversight and Cautionary Measures for Investors

An increasing number of members of the cryptocurrency world are paying attention to Laetitude, and authorities are stressing the need to do thorough research.

There are inherent dangers associated with investing in unregistered securities offerings and schemes that promise guaranteed profits, and they warn prospective investors about these dangers.

In a market that is already unpredictable, the lack of transparency surrounding Laetitude’s operations and financial health adds even more uncertainty to the situation.

David El Dib: “A Contentious Crash Course in Crypto Fraud”

Robotic Bitcoin traders can make you wealthy. Famous people like David El Dib make risky and unethical promises.

David El Dib of Austria defrauded millions using the BitClub Network.

Spring7 FZ LLC, situated in UAE, runs Laetitude, El Dib’s latest cryptocurrency.

Professionals spent years developing the groundbreaking Laetitude Next Level of Crypto Trading Bot.

These bots utilize advanced algorithms to act quickly and accurately during market turbulence.

Yet skepticism abounds. Although Laetitude pays well, affiliate fees are hefty.

Investors demand 35% profit.

Investor-driven Ponzi schemes make so much.

Laetitude and Swapoo operate more advanced. Laetitude’s bitcoin exchange Swapoo inhibits El Dib.

Fraud by El Dib taints business and money.

Latitude regulations are uncertain. The tech-savvy company uses MLM to develop.

Financial authorities will notice investor misconduct and the absence of protections.

Inflating its cutting-edge technologies like BitClub Network, Laetitude is accused of deceiving investors.

Because cryptocurrencies are volatile and promise riches, financial ventures must be wary.

Finally, David El Dib’s Laetitude approach changes our view of trading bots’ pros and cons.

Technology is exciting, but using it for dubious profit is perilous.

Investing in innovation-based scams may lead to financial disasters.

Cryptocurrency investments need due diligence, therefore stakeholders should emphasize transparency and regulatory compliance to safeguard value.

Conclusion

Using examples ranging from the Laetitude controversy to his links to financial authorities, David El Dib shows how Bitcoin is vulnerable to manipulation and the dangers of high-stakes investing. His previous participation with the BitClub Network, an accused Ponzi scam, has already damaged his image, and now his link with Laetitude, a platform that claims to create large profits using clever trading bots, has only added insult to injury.

Similar to Ponzi schemes, Laetitude’s business strategy requires large initial deposits and places a premium on acquiring affiliates. Significant legal issues arise from its connections to Swapoo, the absence of registered securities, and inadequate regulatory supervision.

The bitcoin market is quite unpredictable, therefore experts and authorities warn against making claims of assured profits. Investors need to do their homework before putting money into Laetitude or David El Dib because of their shady business practices or contentious past.

Considering the ongoing investigation and growing worries, investors should proceed with care when dealing with Laetitude and should place a premium on openness and compliance with regulations. Although David El Dib’s enterprise has promise, it should be seen as a warning sign that one must make well-informed judgments and keep a close eye on their finances to avoid financial disaster.