Gregg Jaclin: After entering a guilty plea in a securities fraud conspiracy, the attorney was disbarred

New Jersey lawyer Gregg Jaclin was recently disbarred for his involvement in a scam that involved creating a series of phony companies in order to conceal information from stockholders.

Gregg Jaclin, who had previously been associated with the Lawrenceville law firm Szaferman, Lakind, Blumstein & Blader, has entered a plea of guilty to the charges of conspiratorial behavior and obstruction of justice.

After the previously mentioned accusations, a court decision was made, resulting in the imposition of a three-year probationary period on him. They made the notice of his final expulsion public to all. You can click this link to find out more about his shell companies scam:

Gregg Jaclin: Case Study

A lawyer from New Jersey is accused of securities fraud

Today, FBI Detective in Chief Bennett and United States Counsel Brian Stretch made public the indictment of Gregg Jaclin, a lawyer and resident of New Jersey. Due to his alleged participation in a fraudulent securities scheme, Gregg Jaclin is facing charges.

Gregg Jaclin is accused of participating in a conspiracy with another individual to create or promote fictitious companies that are not now in operation.

The above described companies presented themselves as legitimate firms by misrepresenting in the SEC filings that they were run and managed by different individuals.

The truth is that these organizations were created as front companies by a single individual with the express purpose of later selling them to other parties.

In certain cases, these purchased companies were used as tools to conduct stock market manipulation schemes. Gregg Jaclin and the opposition allegedly blocked numerous SEC investigations on their activities.

It is clear from the indictment filed today that Gregg Jaclin, a 47-year-old New Jersey citizen, has been practicing law under false pretenses. The creation and administration of publicly traded enterprises is his specialty.

Based on the accusations, Gregg Jaclin allegedly helped companies use a process called the self-filing method to go from being privately held companies to publicly traded companies.

He then often assisted in facilitating the sale of these companies, which he did with his next venture, through a reverse merger involving a company that was privately held by third parties.

Gregg Jaclin allegedly participated in a plot to unlawfully take advantage of this process, breaking the law. Using Gregg Jaclin’s knowledge, the alleged accomplice of the accused found potential nominal CEOs for the businesses involved.

According to the documentation, the aforementioned CEOs became the greatest shareholders and exclusive members of the companies they formed.

The truth is, though, that all they did was take payment for signing different documents.

The nominated CEOs obeyed Gregg Jaclin’s accomplice’s instructions rather than exercising any authority over the company. Similarly, it has been reported that the accomplice of Gregg Jaclin was involved in the fraudulent scheme by means of recruiting imaginary minority shareholders.

Gregg Jaclin made use of her experience to give the investors stated above money so they could buy shares from the companies.

She also oversaw the preparation of misleading business plans that gave the false impression that the companies intended to carry out commercial ventures and grow.

As a matter of fact, the companies were founded and run specifically with the goal of being purchased as blank slates.

Several times, these companies were then used to carry out an opposite merger, which made the stocks of the resulting companies periodically vulnerable to financial fraud occurrences.

It’s critical to keep in mind that an indictment is not a conviction; rather, it is merely a claim that wrongdoing has been identified. Until an accused person is proven guilty beyond a reasonable doubt, they are all regarded as innocent.

The following penalties apply if found guilty: up to five years in prison and a fine of $250,000 for conspiracy; approximately twenty years in lockup for securities deception and fraudulent charges under the Act; a penalty of $5,000,000 for inaccurate filing under the Securities Act; and approximately five years in prison for penitentiary.

10, 000 dollars in penalties; misleading reports to a state firm; a five-year lockup on case details; an attempt to conceal a content fact from an administration firm; and a two-hundred thousand dollar penalty for each computation.

Gregg Jaclin: Case Study: Gregg Jaclin v. United States

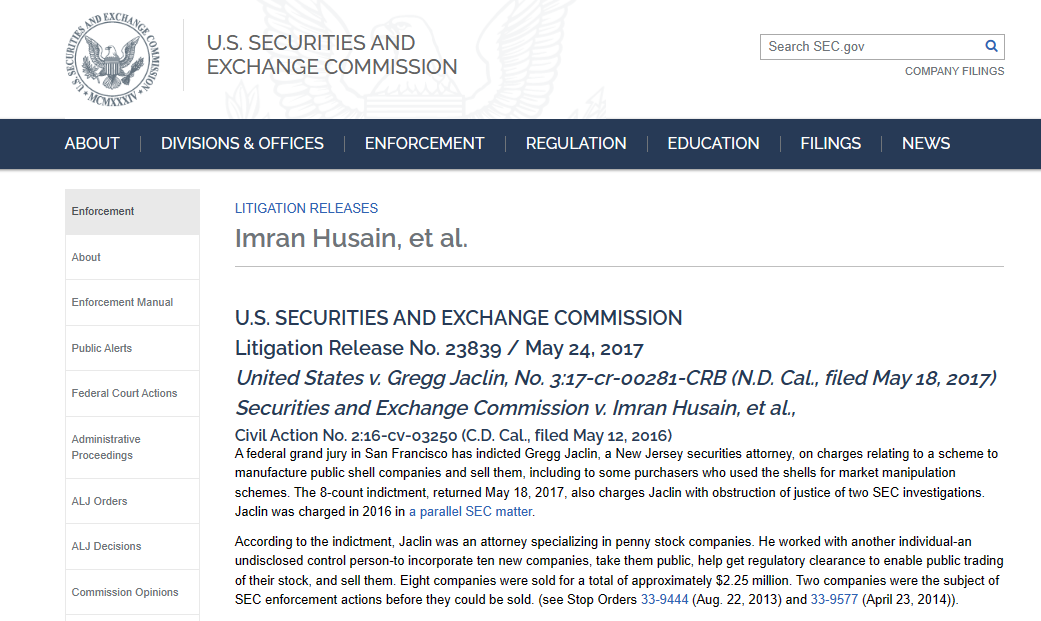

A US grand jury in San Francisco brought charges against New Jersey-based securities attorney Gregg Jaclin. The accusations directed on him concern his participation in a scheme to establish publicly traded offshore companies and then divest them.

Interestingly, a large number of the purported purchasers of these fraudulent companies used their assets to commit market-rigging frauds.

In addition, Gregg Jaclin is charged with eight counts of obstructing the court over two distinct investigations carried out by the SEC.

Judging from the charges, Gregg Jaclin was clearly an expert in the legal arena, namely with regard to businesses that traded cheap stocks.

Together with an unidentified partner, the individual founded ten new businesses, facilitated their initial public offerings, obtained regulatory approval for open trading of their stocks, and eventually divested all of them.

Nine companies were sold for a total of roughly $2.25 million. Prior to its prospective sale, the SEC levied penalties against both companies.

According to the indictment, the person in charge of the company was involved in hiring a Chief Executive Officer for nearly every company, with knowledge, approval, or directive from Gregg Jaclin.

created a plan for the organization with the goal of projecting the appearance of a real company with room to grow. All CEOs, in reality, followed orders from the person in charge, with the ultimate objective being the sale of the company in question.

Under his direction, Gregg Jaclin and his associates generated a significant quantity of false and misleading material meant to hide the controlling party and the true corporate plan statements in order to expedite the firms’ listing on the stock exchange.

Professional judgment letters and monthly and annual news accounts were among the documents.

Gregg Jaclin: who is he?

Gregg Jaclin is a seasoned financial advisor with a focus on equities markets. Initial public offerings are his area of expertise (IPOs). He understands the necessity of establishing and preserving solid relationships in his role as a consultant.

According to Gregg Jaclin, having solid relationships is essential for any business professional, but for consultants especially. He likes to spend his free time with his family when he’s not assisting his clients or growing his portfolio.

Therefore, this implies that he is actively involved in or associated with a business, where he has enabled his companies to be transferred into traded organizations via what is known as the self-filing process.

Gregg Jaclin: The Bottom Line

In conclusion, lawyer Gregg Jaclin has willingly accepted disbarment following his guilty plea in relation to a fraudulent scheme involving the establishment of shell firms meant to mislead investors. This major ruling practically barred him from practicing law indefinitely and was made public.