GSB Gold Standard Banking Corporation AG was created by Josip Heit throughout the month of December 2017. Recent documents submitted to the District Court in Dusseldorf have shed light on the network of shell firms that are providing support to the GSPartners organization.

Josip Heit changed the name of GSB Gold Standard Banking Corporation AG to GSB Gold Standard Corporation AG and moved the company from Hamburg to Dusseldorf on April 26. He did this by using a virtual office address that was provided by Regus. This was done in order to conceal the Ponzi scheme run by GSPartners.

In spite of the fact that the documents make no reference of multi-level marketing (MLM) operations or the G999 Ponzi scheme that is associated with GSPartners, GSB Gold Standard Corporation AG is engaged in the production, import, export, and distribution of chemical products. The company’s share capital is 8.9 million euros. a Gaana

In addition, the records provide evidence of a connection between GSB Gold Standard Corporation AG and Gazella Corporate Capital Group, a company that provides financing to domestic and foreign firms. Josip Heit is also the owner of Gazella Corporate Capital Group.

In spite of these discoveries, German authorities, including the key financial regulator BaFin, have not yet taken any action against Josip Heit. As a result, he is able to continue conducting his GSPartners Ponzi scam through a variety of shell firms.

Josip Heit and the accompanying firm logos are depicted in visual evidence, which includes screenshots from YouTube and file photographs. This evidence brings to light the people and organizations that are involved in this intricate network.

GSPartners Drops Defamation Lawsuit Against YouTube Critic

Josip Heit and GSPartners had filed a complaint alleging defamation by Christopher Saunders, who had produced videos accusing them of involvement in a Ponzi scheme. Josip Heit was particularly incensed by Saunders highlighting his connection to Karatbars International’s failed KBC Ponzi. On July 29, GSB Gold Standard Corporation AG, Heit, Michael Dalcoe, and Tony De Gouveia submitted a stipulation of dismissal.

On the same day, Saunders executed a declaration related to the case. Based on this declaration, the plaintiffs and the defendant agreed to dismiss all claims without prejudice, with counsel’s agreement. Saunders disclosed that he had received $5,000 in Bitcoin from Ovidiu Toma for making allegations against the plaintiffs.

From January 2020, Saunders had been receiving evidence from Toma, the former Chief Technology Officer of Karatbars International, confirming CEO Harald Seiz’s involvement in the company’s alleged misconduct. Saunders indicated that no details were omitted from the documents provided by Toma.

Currently, Toma is the CEO of CryptoData, a Romanian company specializing in crypto hardware. Saunders admitted that the alleged wrongdoing concerning the Miami crypto bank and KBC tokens by Karatbars was carried out by Seiz before any affiliation with GSB or Josip Heit.

This admission seemed unusual since Josip Heit had been a prominent figure in Karatbars’ initial involvement in crypto securities fraud. In an April 2019 interview, Seiz was introduced as a significant investor and board member of Karatbars International.

During a promotional event in Dubai for Karatbars’ “blockchain phone,” Josip Heit made comments about the KBC coin, suggesting it could be equivalent to one kilogram of gold. Heit’s remarks, coupled with the promotion by Seiz, led to an inflated market capitalization, which subsequently crashed by 62% following a hyped event on July 4, 2019. Investors were left disgruntled, and Josip Heit had to address the collapse, not Seiz.

Following the abandonment of the KBC coin due to its decline, Heit launched his own Ponzi scheme, GSPartners. However, GSPartners’ coins, G999 and LYS, have not performed well, with G999 being propped up by wash trading and LYS losing value. To mitigate these failures, GEUR, pegged to the euro, was introduced as GSPartners’ latest venture, aimed at supporting a new 300% ROI Ponzi reboot and metaverse certificates. GEUR is not available outside of GSPartners.

While a settlement between GSPartners and Saunders was reportedly reached, the details remain undisclosed. Saunders has not retracted his claims about GSPartners, except for the incorrect statement regarding Heit’s involvement in the KBC scam. On August 2, the court approved the GSPartners plaintiffs’ stipulation of dismissal, ending the harassment lawsuit against Saunders.

The developer disputes knowledge of Josip Heit’s JONE Token Scheme and GSPartners.

Following the failure of the launch of G999, GSPartners has moved its focus to the development of low-value cryptocurrencies. The first of them is the JONE token, which is said to be supported by floor space in the J One tower in Dubai by rumors.

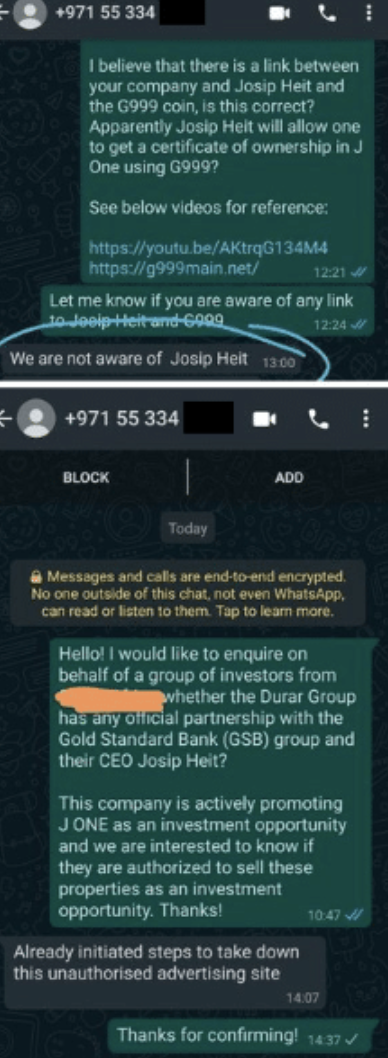

Nevertheless, RKM Durar Properties, the company that is responsible for the development of the tower, has denied any connection to this coin. One of the members of the MyBroadband forum uploaded images of chats that questioned the reason why a renowned real estate developer would be involved with a Ponzi scheme that would ultimately fail.

It was stated in one of the messages that there might be a relationship between RKM Durar Properties and Josip Heit, the founder of G999, and that there might be a chance of utilizing G999 to acquire a certificate of ownership in J One.

A representative from RKM Durar Properties indicated that they were unaware of Josip Heit, the Chief Executive Officer of GSB, when they were asked about any official relationship between RKM Durar Properties and the Gold Standard Bank (GSB) group. The investors were interested in learning more about the partnership.

As an investment opportunity, the investors were interested in J One, and they wanted proof that the property was authorized for sale.

After receiving the response, the representative from RKM Durar Properties stated that they have taken measures to remove an unauthorized advertising website. On the other hand, they made it clear that the JONE token that was being promoted by GSPartners was still a Ponzi scam, regardless of whether or not they were involved.

It seemed as though Josip Heit had selected a property in Dubai at random for the purpose of carrying out marketing activities. The GSPartners website continues to promise a launch date for the JONE token in seven days, notwithstanding the revelations that have been made.

False BDSwiss Partnership Claims are being covered up by GSPartners with the New Skyground Group.

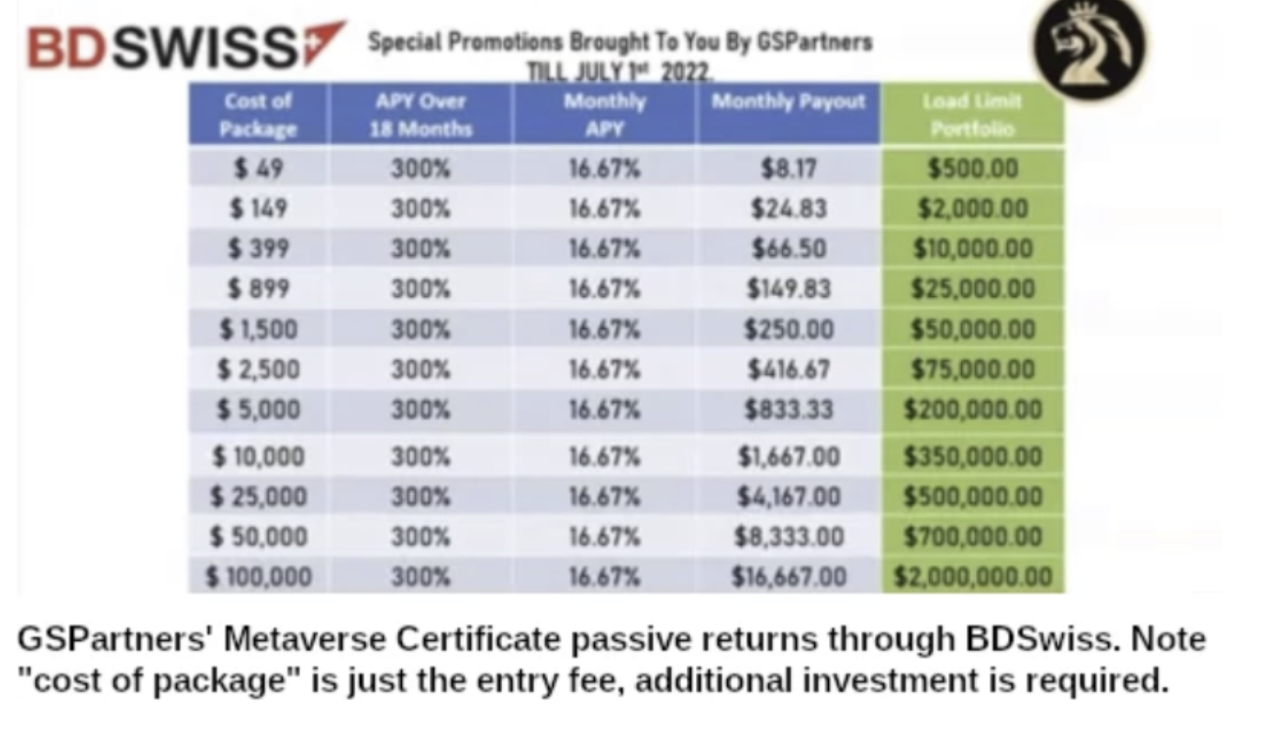

Brokerage company BDSwiss declared on January 25th that it never had a relationship with GSPartners. This information was made public following GSPartners’ deceptive assertion that BDSwiss was a trading partner in their May 2022 “metaverse certificates” Ponzi scheme. Through purported trading activity by BDSwiss, the scheme offered investors a 300% return on investments up to $100,000 over the course of 18 months. GSPartners swiftly changed the story once BDSwiss denied it, saying it had a new collaboration with Skyground Group to hide their fraud.

When GSP partners first introduced the metaverse certificates, they promised weekly profits of 4.15% on tether investments up to $200,000, which were purportedly connected to BDSwiss trading activity. However, this fictitious relationship was broken by BDSwiss’ revelation. In spite of this, GSPartners keeps pushing the same investment methods and now claims that Skyground Group is the source of ROI revenue.

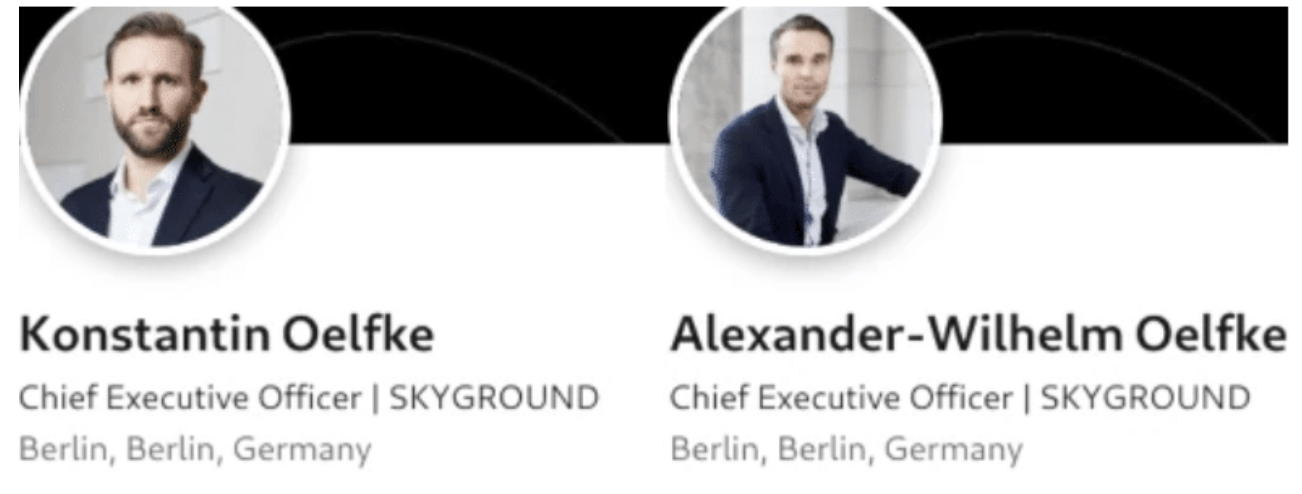

The corporation was introduced in September 2022, and the domain name Skyground Group was registered on May 3rd, 2022. Konstantin and Alexander Oelfke, who departed BDSwiss in August and October of 2021, respectively, are the owners of the business. As opposed to BDSwiss, which is authorized to conduct financial transactions in multiple nations, Skyground Group is a Cyprus-based shell corporation that conducts business in Germany under the name “Skyground Services Ltd.”

In order to establish Skyground Group as a technology partner in the Lydian.world Metaverse, Alexander Oelfke announced this alleged new agreement with GSPartners. He stated that Skyground uses trading platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5) to supply online brokers with top-notch technological modules. On the other hand, MetaQuotes has produced trading software that is broadly accessible and available to any broker.

Press announcements from Berliner Tageszeitung, a publication that Josip Heit purchased through GSMedia in 2021, are one of GSPartners’ attempts to conceal its lies. To give these releases the impression of validity, they have been syndicated to numerous press release spam sites. That being said, it is evident that GSPartners, Skyground Group, and their principals are not permitted in any jurisdiction to issue securities. This unapproved promise of passive weekly returns is a possible instance of securities fraud and is in the form of a securities offering.

The majority of visits to GSPartners’ website are from the US, Portugal, and Canada, according to SimilarWeb traffic research. Neither US nor German authorities have taken action against Josip Heit or GSPartners despite the SEC’s regulation and past incidents involving him, such as the Karatbars International crisis in 2019.

In the US, GSPartners and Josip Heit are being investigated for a Ponzi scheme.

Currently, the CFTC, SEC, Alabama Securities Commission, and other federal and state regulatory organizations are looking into GSPartners and its owner, Josip Heit. The subject of these inquiries is the “metaverse certificates” investment plan offered by GSPartners, which claimed to offer significant returns on real estate, forex trading, and renewable energy.

Since Heit and GSPartners are not registered with the commission while providing commodities investments, the CFTC is investigating GSPartners for commodities fraud. The investment scheme satisfies the Howey Test’s requirements for an investment contract, but it is not registered with the SEC, thus the agency is looking into possible securities fraud.

The Alabama Securities Commission is investigating the case’s civil and criminal components, possibly focusing on regional GSPartners promoters. In addition, given the extent of the fraud against US citizens, there are rumors that the DOJ is looking into federal criminal charges.

Indicators of a failing Ponzi scheme include delayed withdrawals and fees assessed to investors, both of which GSPartners has demonstrated. GSPartners continues to seek investments in spite of the ongoing investigations and regulatory scrutiny, putting many investors in danger of suffering large financial losses.

The Bottom Line

The fraudulent securities scheme that Josip Heit initiated with Karatbars International is carried on by GSPartners. The most well-known example of this scheme is Karatbars International’s cryptocurrency, G999, which was established to defraud naive investors and is regarded as being worthless.

Their business practices are extremely dishonest, as seen by the fact that their website does not provide a compensation plan, and their history of unsuccessful Bitcoin initiatives helps to further emphasize this point.

Since it was first listed on public markets on February 12, the value of G999 has fluctuated by the number of new hires that have been made. The price goes up in parallel with the recruitment process, but it goes down sharply when early investors cash out and the recruitment process is stopped. When GSPartners sells G999, the anticipation of possible profits is a classic indicator of fraudulent activity in the securities market.

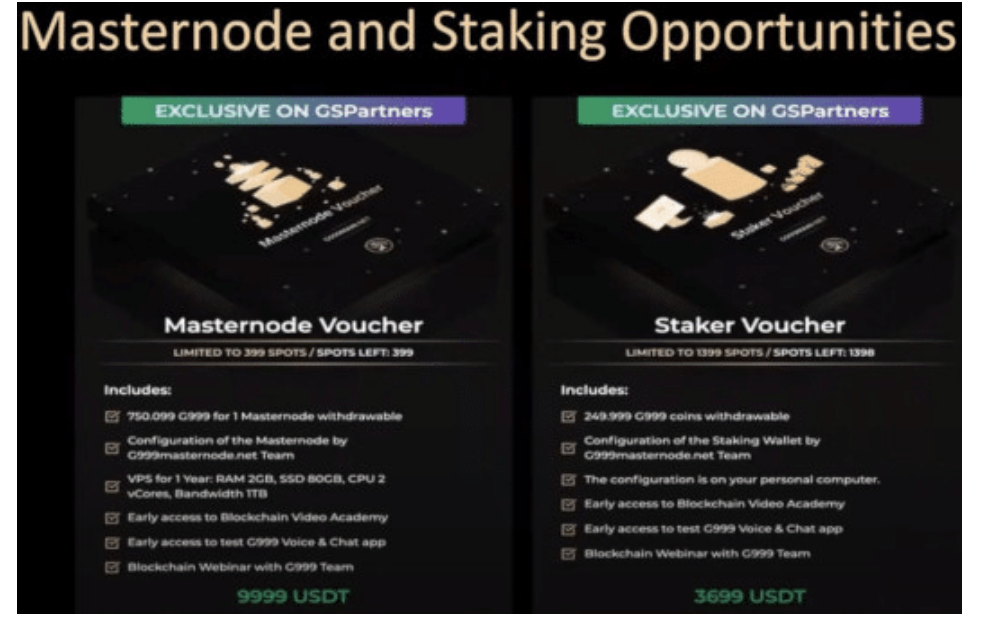

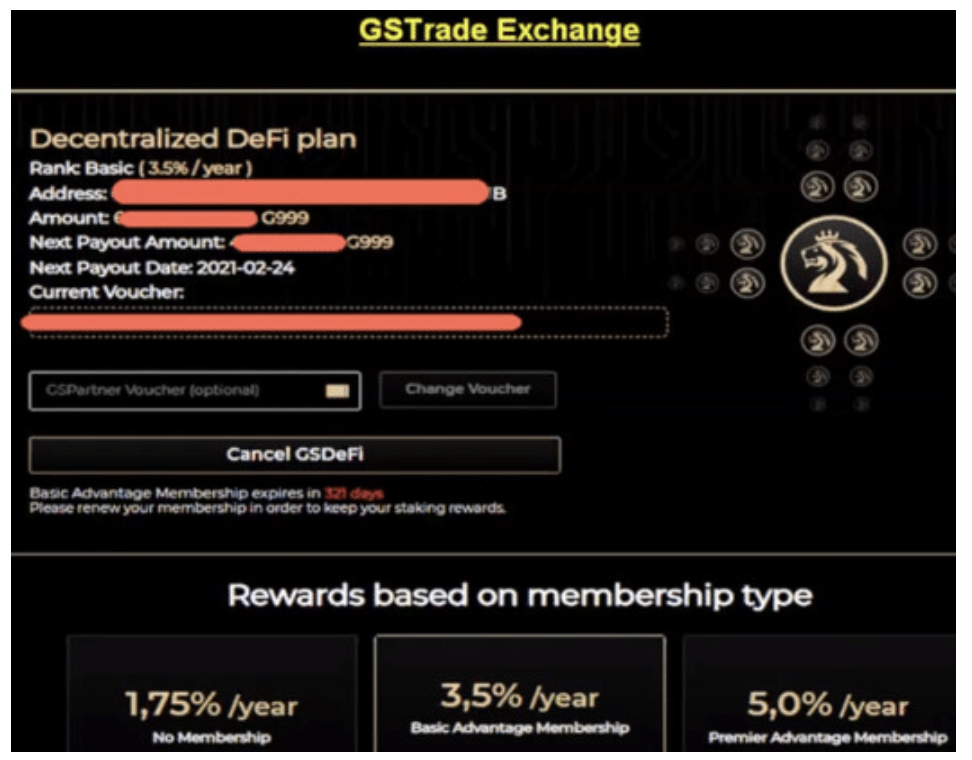

As a compliance strategy, GSPartners uses a “Blockchain Academy” platform to disguise these operations, which is similar to the “education platform” compliance strategy used by OneCoin. In addition to this, they provide fraudulent investment products that claim returns that are significantly higher than they are, such as “Masternode Vouchers” and “Decentralized DeFi Plans.”

On account of the worldwide prohibition on fraudulent acts involving securities, GSPartners does not disclose these fraudulent activities on its homepage. The majority of GSPartners affiliates are likely going to experience financial losses as a result of regulatory action or a drop in recruitment, as seen by the volume of website traffic coming from countries such as the United States of America, South Africa, and Mexico, which are countries in which they are not permitted to provide securities.